Social Responsible Investment

"Because it creates not just profit but efficiency, impact, and equitability"

Why

Resources on our planet are not evenly distributed. In Kosovo, for example, 17.6% of the population currently lives below the poverty line.

How

Our approach is to issue micro-bonds under the cover of our own rescue fund and to make these funds available to precisely those people who are excluded from the financial market.

What

Schweitzer & Hirscher Development Association enables

private individuals to invest directly and efficiently in education, agriculture, micro-enterprises and social projects in developing countries.

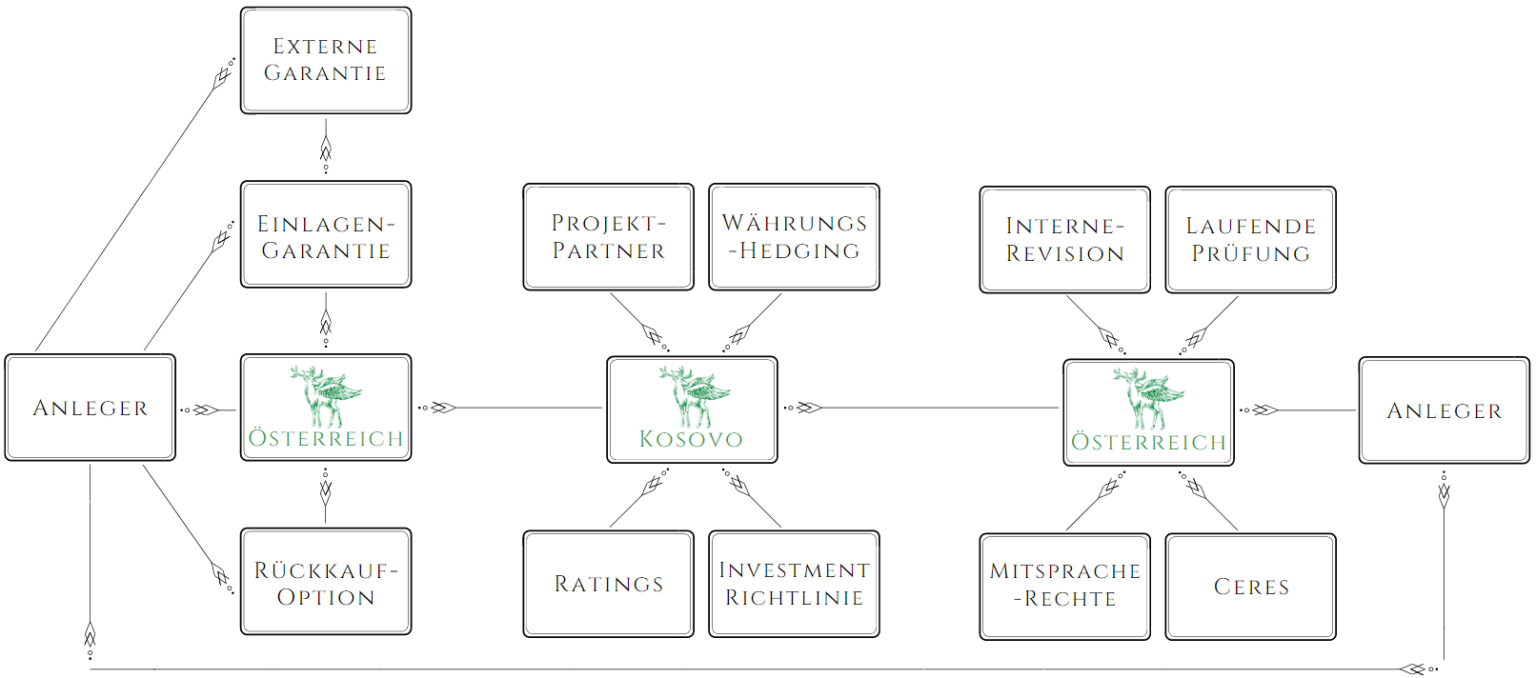

Investment-Cycle

All instances of the Schweitzer & Hirscher Develeopment Association at a glance

1. Step

The investor invests through us in his desired category and target region. This bond is reinforced by our own 16% equity fonds as well as, if necessary, covered by an external insurance. In addition, each investor receives the right of repurchase option of this financial product.

2. Step

The deposit is hedged against currency losses free of charge for you and distributed to the final beneficiaries in the form of microloans in compliance with the ecological and social investment guidelines together with our project partners. Project partners are exclusively development banks or microcredit institutions on site, which we have subjected to our own rating.

3. Step

The Schweitzer & Hirscher Development Association monitors the projects on an ongoing basis, and we have commissioned both a Supervisory Board and a Sustainability Committee with internal auditing. All of this is done in compliance with the Ceres Principles. As an investor, you have the opportunity to actively participate at any time; however, you will be informed about the social as well as economic progress of your investment on a quarterly basis.

"Money in particular has an enormous impact on the environment and society. That's why you, the customer, decide where and what impact it should promote."

- Florian Schweitzer, Sustainability Committee

Our Projects in the Regions

"How your investment may change lives."

Education

In Podujevë there is now a higher technical school for

100 young people, in which the Matura can be completed.

Today, you are making a one-time investment of €15,000, thus enabling practical

education. For your participation you will receive €1.800 after 3 years. Partial investments from €100 are also possible.

Small Entrepreneurs

Elona from the village of Lešak wanted to start her own business with her self-made sheep soaps, and this is now possible due to you.

You invest €200 in start-up capital today and Elona may fulfill her lifelong dream.

Agriculture

From his farm in Graboc i Epërm, Mergim supplies

Pristina, the capital of Kosovo, with fresh fruit and vegetables.

With your investment in the amount of €2,500

you will enable Mergim to buy a new transport vehicle and receive €300 in addition to your investment.

Female Empowerment

In Breznë, farrier and hoof care specialist Leonita helps

dairy cows and their owners by training

hoof trimmers. In Kosovo, farmers pay

around €7 for the hoof care of a cow. A trained

could charge up to €15 per cow and earn good money.

Renewable Energy

Altin, a winegrower near Rahoveci, can now afford his own

solar plant that generates electricity and supplies his production,

and the people of the small suburb with electric light.

You invest today €17.000 and receive in return

€680 per year for your investment. Join us in supporting this important project in Kosovo.

"Leaving savings in a savings account inevitably means losing money in the long term. There will be no more good interest rates in the near future. In the long term, therefore, it will no longer be possible to save for financial growth, but to generate this through social and prudent investment!"

- Gregor Hirscher, Chairman & CLO

What Type of Investor are you?

The following types are available for selection...

"We won't sell you anything we don't believe in ourselves. That's why we're committed to having at least 16% equity in every bond we invest."

- Rebecca Humborg, Chair of the Sustainability Committee

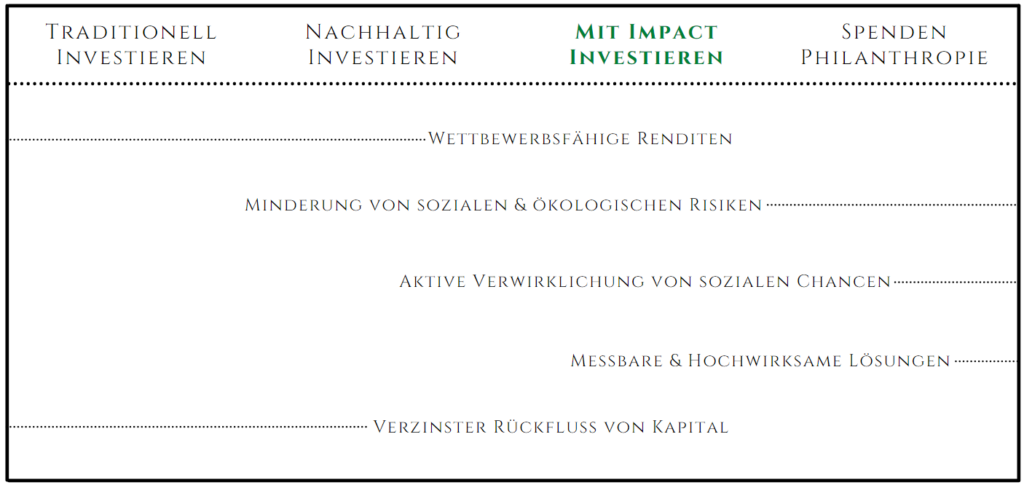

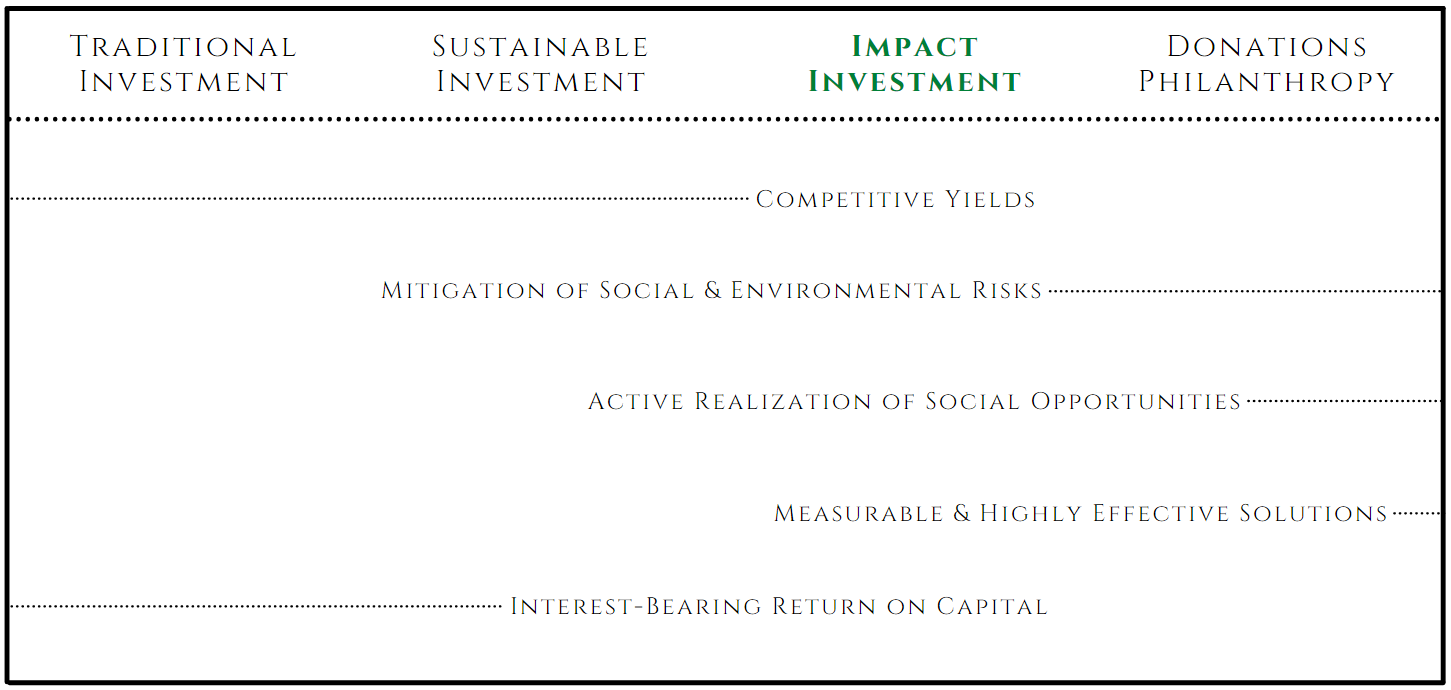

Impact Investment

"Through us, your investment directly reaches people who would otherwise be excluded from the financial market due to their life situation. Through your investment you create growth and self-determination in the region"

Investments in microcredits fall into the category of impact investing. There economic and financial returns, but also

financial returns, goals in the social and

and environmental goals are also achieved and monitored.

"Impact investing not only generates

competitive returns by means of

interest-bearing return on capital, but also

actively pursues opportunities for

social environmental governance through

measurable, high-impact solutions."

"Here the ESG criteria defined by the UN

Criteria as well as the SDGs serve as a guide. The

most common forms of impact investing

are microcredits, which will become increasingly

more and more important in the future."

What is a microcredit?

Microcredit was developed in Bangladesh around 1983 by Muhammad Yunus, who later won the Nobel Prize. Microcredit institutions grant small amounts of money as loans to financially weak self-employed persons and microenterprises. Borrowers thus have additional capital at their disposal, which they can freely use as an investment good to increase their work output and efficiency.

As a result of fair interest rates, borrowers can achieve higher profits and thus increase their income stability in the long term. What seemed impossible due to a lack of reserves or collateral turned out to be an absolutely successful model. To date, this system has been successfully implemented in most developing countries. The goal of microcredit is always to promote self-reliant and sustainable development.

How does a microcredit work?

If a company or project applies to a local development bank, it is assessed according to certain economic criteria, the likelihood of success, and also social and ecological points, depending on the institution. If the company meets the requirements, it can apply for a microloan. The term is usually only a few months, with close customer contact and support.

To ease the interest burden, interest rates are adjusted individually according to project and profitability. Due to currency differences, as well as the purchasing power of the respective country, the required financial resources are often only a few hundred euros. The repayment rate is on average a sensational 98%, as well as studies show that 8 out of 10 borrowers were able to improve their situation in the long term.

"Our innovations are the defining Alliance with our Future."

- Johanna May, Sustainability Committee